Description

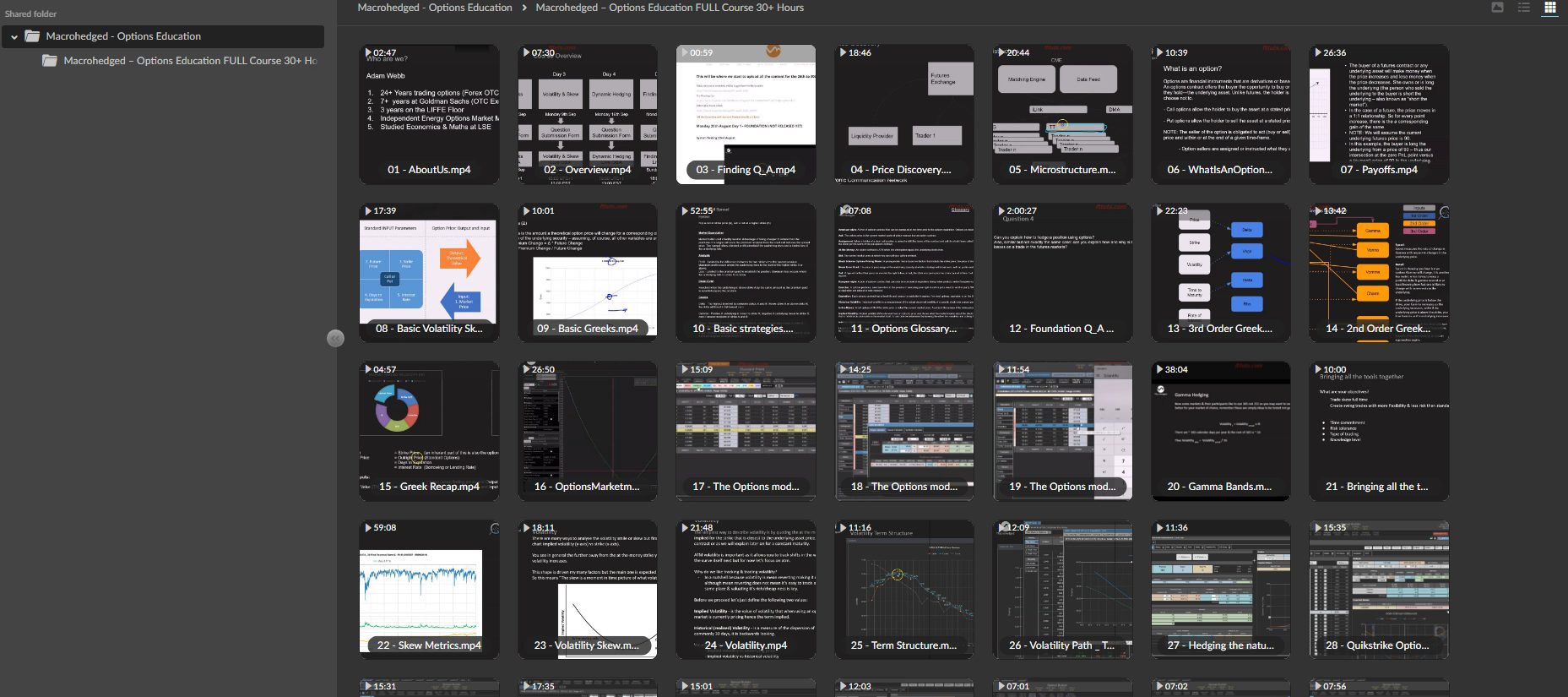

Macrohedged – Options Education Content Proof:

Macrohedged – Mastering Options Education

Unveiling Macrohedged: Your Path to Options Mastery

Navigating the complexities of options trading can be a formidable challenge, but with Macrohedged, we offer an unparalleled educational experience designed to elevate your trading skills to new heights. Whether you’re a novice eager to understand the fundamentals or an experienced trader seeking advanced strategies, our Options Education FULL Course is crafted to meet your needs and surpass your expectations.

Comprehensive Overview of Macrohedged Options Education

Foundation Day: Building a Strong Foundation

The initial phase of the Macrohedged course, Foundation Day, provides a thorough grounding in options trading. This segment ensures that every participant, regardless of their prior knowledge, gains a robust understanding of essential concepts. Here’s what you’ll master during Foundation Day:

- Market Microstructure: Gain insights into the underlying structure of the market and how it influences trading decisions.

- Options on Futures: Familiarize yourself with trading options on futures and the distinctive characteristics of various futures exchanges, including CME, EUREX, and ICE.

- The First Order Greeks: Delve into the primary Greeks—delta, gamma, theta, and vega—and learn how these metrics affect options pricing and trading strategies.

- Option Valuation: Learn the methodologies for accurately determining an option’s value and understanding its implications on your trading positions.

- Glossary of Terms: Acquire the crucial terminology and jargon used in options trading to enhance your communication and comprehension.

By the end of Foundation Day, you will have a solid grasp of the basics, setting the stage for a deeper exploration in the subsequent module.

DeepDive: Advanced Strategies and Techniques

Following the foundational training, the DeepDive module takes you into the advanced realm of options trading. This extensive segment covers intricate topics that are crucial for mastering options strategies:

- Trading Spreads and Strategies: Explore various spread types and trading tactics used by seasoned professionals.

- The Black-Scholes Model and Binomial Trees: Understand these pivotal models for options pricing and their applications.

- Market Makers: Learn about the roles of market makers, how they operate, and how to effectively interact with them.

- Volatility Concepts: Grasp the fundamentals of volatility and its impact on options trading.

- Trading Skew: Gain expertise in trading skew, including RR (Risk Reversal), BF (Butterfly), and route trading.

- Dynamic Hedging: Discover techniques for dynamically managing and hedging your options portfolio.

- Risk Management: Recognize the risks associated with options trading and strategies to mitigate them.

Advanced Greek Metrics and Sensitivities

Our course extends beyond the basics, providing an in-depth analysis of advanced Greek metrics and sensitivities, including:

- Second Order Greeks: Vomma, Charm, Vera, and Dvega time—learn how these affect options trading.

- Third Order Greeks: Understand Color, Speed, Ultima, and Zomma, and their influence on options pricing.

- Option Sensitivity: Analyze how options react to various influences and position sensitivities.

Integrative Learning: From Theory to Practice

In the final phase, we consolidate all the concepts learned throughout the course into actionable insights. You will:

- Volatility Surface: Explore the volatility surface and its effects on trading strategies.

- Volatility Diffusion and Dynamic Replication: Understand how these concepts influence options trading and strategy formulation.

- Comprehensive Strategy Application: Learn to integrate all acquired knowledge to develop and implement profitable trading strategies.

Begin Your Journey with Macrohedged

The Macrohedged Options Education FULL Course is meticulously designed to equip you with a comprehensive understanding of options trading, from foundational principles to advanced techniques. Whether you are beginning your trading journey or looking to refine your expertise, our course provides the tools and knowledge necessary for success.

Enroll today and take the first step toward mastering the art of options trading with Macrohedged. Your path to becoming a proficient options trader starts here.

If you’re interested in delving deeper into any particular course or catching a glimpse of its content beforehand, don’t hesitate to get in touch with us via our Email or Telegram accounts. We’re here to promptly furnish you with all the information and evidence you require!

GPKDeals.com stands out as an affordable option for individuals seeking quality courses without breaking the bank.

Explore additional courses from our listings: Click Here

Reach us via Email: Click Here

Connect with us on Telegram: Click Here

Feel Free to contact us