Description

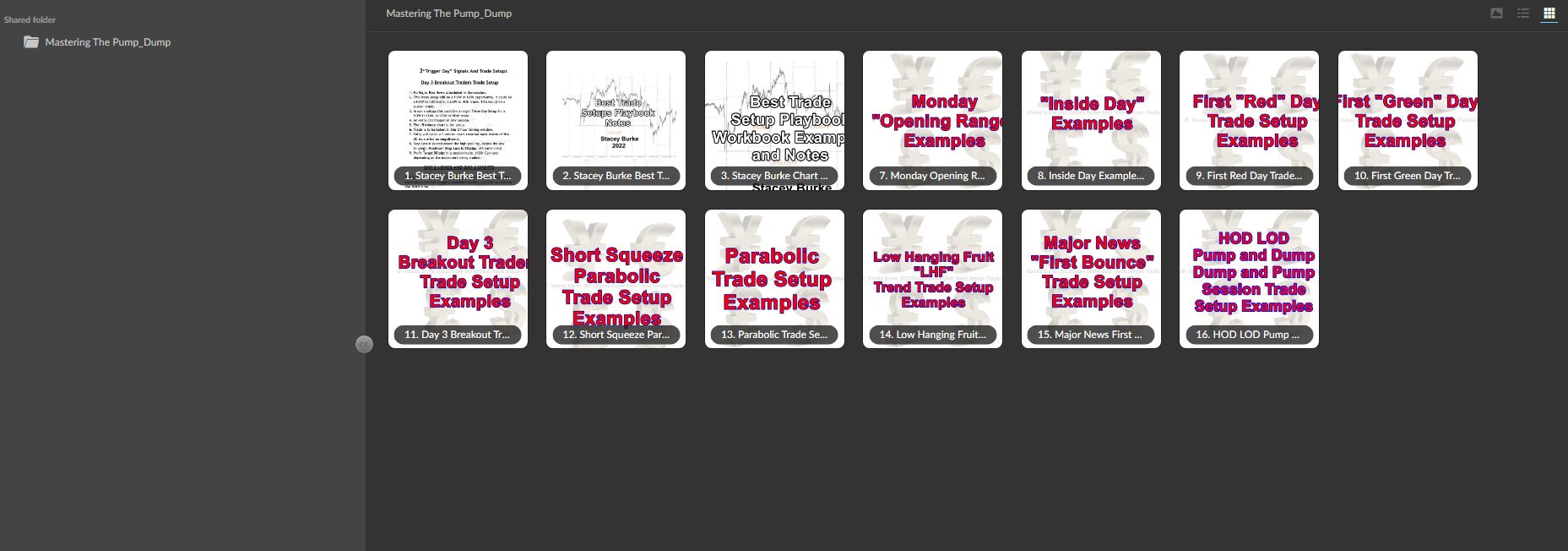

Mastering The Pump_Dump Content Proof:

Unveiling the Reality Behind Pump and Dump Strategies

Exploring the Underbelly of Pump and Dump Strategies

In the realm of investment, the term “Pump and Dump” has garnered both notoriety and intrigue. Many investors tread cautiously around this strategy, primarily due to its association with illegal practices and the inherent risks it poses. Yet, within the intricate web of financial maneuvers, questions persist: Are pump and dumps truly profitable?

Deciphering Pump and Dump Dynamics

Understanding the Fundamentals

Pump and dump strategies unfold with a tantalizing rise in asset value, swiftly followed by a precipitous fall – the “dump.” According to the Securities and Exchange Commission (SEC), this tactic is unequivocally illegal. Perpetrators of pump and dump schemes artificially inflate asset prices, often through fraudulent means, before offloading their holdings at inflated rates.

Identifying Hotbeds of Activity

These deceptive tactics predominantly thrive in markets characterized by lax regulations, such as penny stocks, OTC (Over The Counter) markets, and sectors with minimal oversight. Moreover, markets withholding performance metrics become fertile ground for such dubious maneuvers.

Drawing Parallels and Contrasts

While likened to Ponzi schemes by regulatory bodies, pump and dump operations also draw comparisons to legitimate market movements like short squeezes. However, the latter relies on tangible metrics rather than fabricated hype to bolster undervalued stocks.

Navigating the Perils: Pump and Dump vs. Short Squeeze

Analyzing Market Behavior

A critical divergence lies in their trajectory: a short squeeze typically exhibits a sharp ascent following a brief dip, whereas a Pump and Dump maintains an upward trajectory until the inevitable crash. Both, however, spell trouble for unsuspecting investors who fail to discern the underlying realities.

Deconstructing the Modus Operandi

The Seduction

Pump and dump ploys prey on the allure of quick profits, enticing novice investors with promises of substantial returns. Fraudulent stakeholders orchestrate elaborate marketing campaigns, replete with misinformation and exaggerated claims, painting a rosy picture of the targeted asset.

The Ascent and Fall

As the fervor intensifies, a surge in demand artificially inflates the asset’s value, propelling it to dizzying heights. Yet, this ascent is short-lived, swiftly giving way to a mass exodus as insiders unload their shares, leaving unsuspecting investors holding the bag.

Safeguarding Your Investments

Empowering Investors with Knowledge

Awareness serves as the most potent antidote against falling victim to pump and dump schemes. Equipping oneself with a comprehensive understanding of these deceptive tactics arms investors against potential pitfalls, allowing for informed decision-making and risk mitigation strategies.

In conclusion, while the allure of quick riches may be tempting, the treacherous waters of this strategies often lead to financial ruin. By fostering a culture of vigilance and discernment, investors can safeguard their portfolios against the siren call of illicit schemes, steering clear of turbulent tides and charting a course towards sustainable prosperity.

If you’re interested in delving deeper into any particular course or catching a glimpse of its content beforehand, don’t hesitate to get in touch with us via our Email or Telegram accounts. We’re here to promptly furnish you with all the information and evidence you require!

GPKDeals.com stands out as an affordable option for individuals seeking quality courses without breaking the bank.

Explore additional courses from our listings: Click Here

Reach us via Email: Click Here

Connect with us on Telegram: Click Here

Feel Free to contact us